Home : What we do : Legal Support services : Legal head notes drafting

Our Head Notes Team consists of lawyers, qualified in India, with excellent language skills; keep interpretation skills, and a sharp understanding about the legislative process, procedure, evidence, bias and justice.

We service publishers throughout the country, and can start at the rate of 1000 head notes a month, scaling up to 5000+ head notes a month, within 3 months.

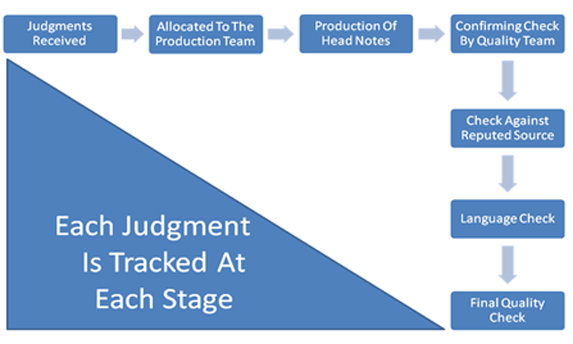

The team is divided into production staff, quality staff and language editors. Each head note passes through these three stages.

We draft head notes in all subjects, and have staff with experience in specialized areas like Consumer matters, Service matters, and others.

We draft head notes both in the web style, and in the print style.

We also offer services like shepherdizing, where the forgoing and proceeding cases that referred the judgment being shepherdized are listed for easy cross reference and to ascertain the validity of the judgment bring shepherdized.

Finally, we offer services in treatment, where cases referred in the judgment treated are classified into “Overruled”, “Upheld”, “Distinguished”, “Referred” & “Relied On”.

EXAMPLES:

WEB STYLE HEAD NOTE

K. Appa Rao – Vs. - Commissioner of Income-tax

[1962]-46-ITR-511-(MAD.)

Section 12(2) of the Income Tax Act

The appellant-assessee borrowed a sum of rupees one lakh from a bank and purchased shares in a public limited company. He paid interest on the loan during the year of account. During that year he derived no dividend from the shares in that company or any other shares owned by him. He had other income which was assessable and was in fact assessed under the head "other sources"; and he claimed that the interest payment was to be deducted from the income from other sources before the assessable income under that head could be computed. The Income-tax Officer refused this relief on the ground the assessee borrowed more than a lakh of rupees from this bank for investing in shares of a limited concern. No income was derived from this company so far. This interest payment could not be allowed under 'business' as the borrowed money was not utilized for business purposes.

The question arose whether the interest payment could be set off against the income from ground rents received by the assessee and assessed under the head 'other sources'.

According to Section 12(2) it was not necessary to show that the expenditure was a profitable one or that in fact any profit was earned, it was enough to show that the money was expended to direct and immediate benefit to the trade and in order indirectly to facilitate the carrying on of the business. If there were several distinct sources coming under the same head set out under Section 6, there was to be an adjustment of the profit and loss under the different sources before the assessable income under the major head could be computed. It was not denied that the assessee was in receipt of income which also falls under the head "income from other sources".

It was held that the interest payment on sums borrowed for purposes of investing in shares was an allowable item of expenditure under Section 12(2). No dividends were received from those shares and assessee was not a debenture holder.

Held: Appeal allowed. Costs in favor of appellant.

Referred: Kameshwar Singh v. Commissioner of Income-tax [1957] 32 ITR 377

Anglo-French Textile Co. Ltd. v. Commissioner of Income-tax [1953] 23 1TR 82

Eastern Investments Ltd. v. Commissioner of Income-tax [1951] 20 ITR 1

PRINT STYLE HEAD NOTE

Constitution of India - Article 14, 16 and 226 - The petitioner was issued the hall ticket for appearing in the written test of Public Service Commission - The petitioner's application was treated as a valid one - Later it was rejected, as the category was wrongly mentioned as 84/06 instead of 83/06 - Issue was - Whether the rejection of the application for wrongly recording the category number was justified or not – Court held - Category number 83 was for direct recruitment from open market and category number 84 was for by transfer - The category number was vital for the validity of the application - If the applications of such candidates were accepted, then that would be violative of the instructions issued to the candidates - There could not be estoppels in these matters and merely because a hall ticket was issued to the petitioner - It could not be said that the Commission was bound by it and could not at a later stage reject the application - Writ petition dismissed.

(Para 4, 5 and 12)

Cases Referred:

1. Kuriakose v. State of Kerala and others (1984 KLT 925).

2. Manoj Kumar v. Kerala Public Service Commission (1999 (2) KLT 534) Binimil K.G. v. K.P.S.C. (1997 (2) KLJ 477).

3. T. Jayakumar v. A. Gopu and another {(2008) 9 SCC 403}.

CASE STUDY HEADNOTES DRAFTING- PROCESS FLOW

Email : info@zetasoftech.com

Call us : 0712-2240594

0712-2249801

Skype : msw.zil

Yahoo : malswa2003@yahoo.com